Monthly Market Brief - Ashoj 2081

Market Brief For Ashoj 2081

Monthly Market Brief - Bhadra 2081

Published: 11 October, 2024 | By: Tathyanka Admin

Finance sector loses its charm but still remains the top performing sector this year

Index Returns (%) – Periodic Performance Additional Information

| Index | Level | 1 Month | 3 Month | QTD | YTD | 1 Year | 3 Year |

LTM P/E |

P/B |

Mkt Cap (Bn) |

Weight |

|

| NEPSE | 2,580.76 | -14.00 | 22.18 | 15.19 | 27.43 | 31.34 | -8.24 |

40.72 |

2.89 |

4,137.61 |

100.00% |

|

| Banking | 1,451.25 | -13.87 | 29.35 | 18.83 | 37.01 | 15.33 | -23.92 |

18.76 |

1.74 |

1,120.64 |

27.08% |

|

| Development Bank | 5,093.95 | -11.61 | 22.34 | 14.90 | 28.62 | 37.37 | -2.63 |

31.53 |

2.98 |

187.37 |

4.53% |

|

| Finance | 3,108.52 | -19.23 | 36.31 | 19.37 | 54.27 | 85.76 | 15.84 |

274.76 |

5.38 |

100.59 |

2.43% |

|

| Hotels | 6,412.12 | -17.33 | 18.31 | 15.33 | 25.29 | 17.51 | 91.40 |

88.99 |

8.97 |

115.89 |

2.80% |

|

| Hydropower | 3,196.41 | -16.10 | 22.35 | 14.83 | 28.79 | 61.32 | -1.31 |

277.95 |

3.58 |

617.67 |

14.93% |

|

| Investment | 105.20 | -14.29 | 35.69 | 25.85 | 38.80 | 53.22 | 7.16 |

75.51 |

3.89 |

332.06 |

8.03% |

|

| Life Insurance | 12,563.83 | -14.62 | 22.82 | 16.68 | 22.83 | 17.44 | -20.45 |

73.90 |

4.50 |

376.26 |

9.09% |

|

| Manufacturing | 6,906.46 | -13.93 | 4.74 | 2.66 | 2.29 | 34.37 | 4.78 |

124.70 |

4.42 |

234.32 |

5.66% |

|

| Microfinance | 4,938.15 | -8.89 | 4.94 | 2.49 | 23.31 | 38.85 | -6.73 |

49.01 |

5.13 |

373.18 |

9.02% |

|

| Mutual Fund | 21.17 | -5.02 | 11.66 | 3.67 | 15.87 | 14.31 | 36.14 |

n/a |

n/a |

34.00 |

0.82% |

|

| Non Life Insurance | 12,929.83 | -9.98 | 20.32 | 15.65 | 22.92 | 23.87 | 1.97 |

51.17 |

4.11 |

243.58 |

5.89% |

|

| Others | 1,978.85 | -15.81 | 21.53 | 16.77 | 16.31 | 37.74 | 8.46 |

29.42 |

1.98 |

380.97 |

9.21% |

|

| Trading | 3,621.60 | -14.10 | 21.76 | 18.79 | 29.74 | 21.01 | 10.73 |

299.32 |

10.91 |

21.08 |

0.51% |

|

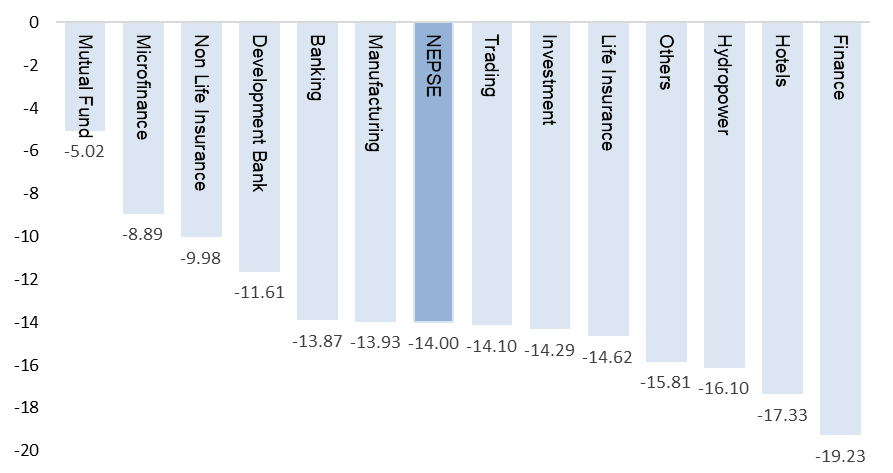

Index Returns (%) – Bhadra |

Index Returns (%) – YTD |

|

|

Pump and dump concerns in plummeting low-float finance stocks signal a similar risk for low-float microfinance stocks, which have seen an irrational rise

|

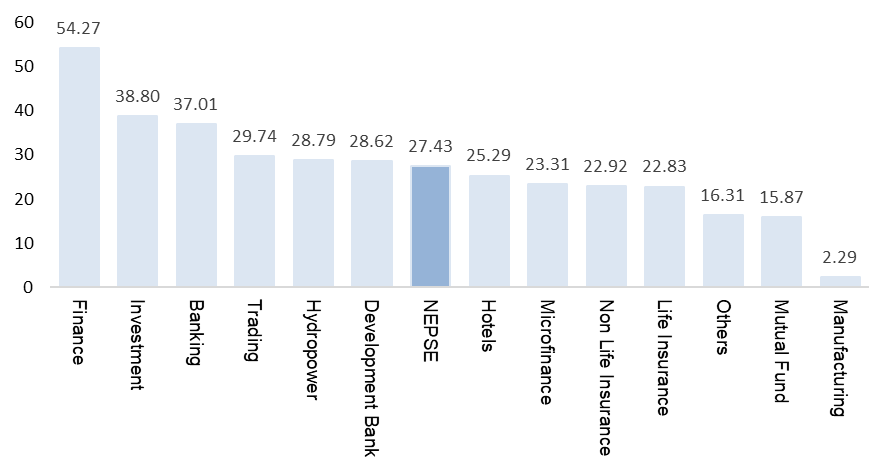

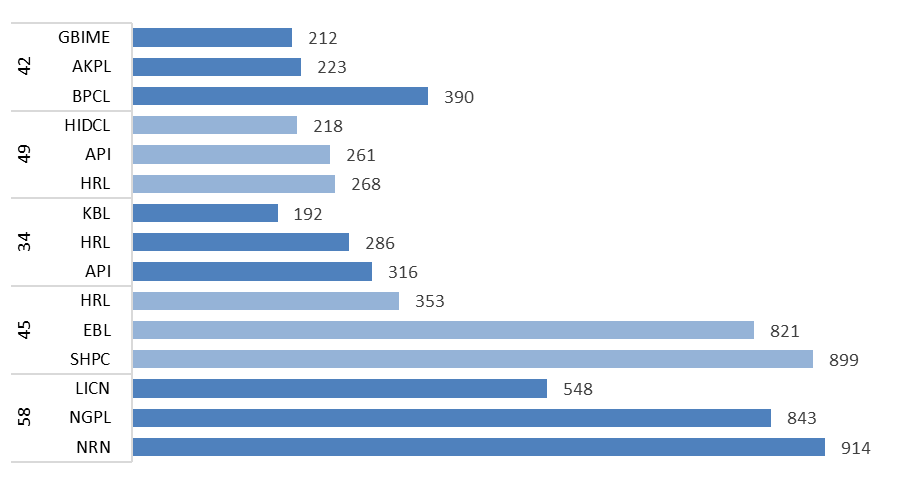

Winners – Bhadra (In %) |

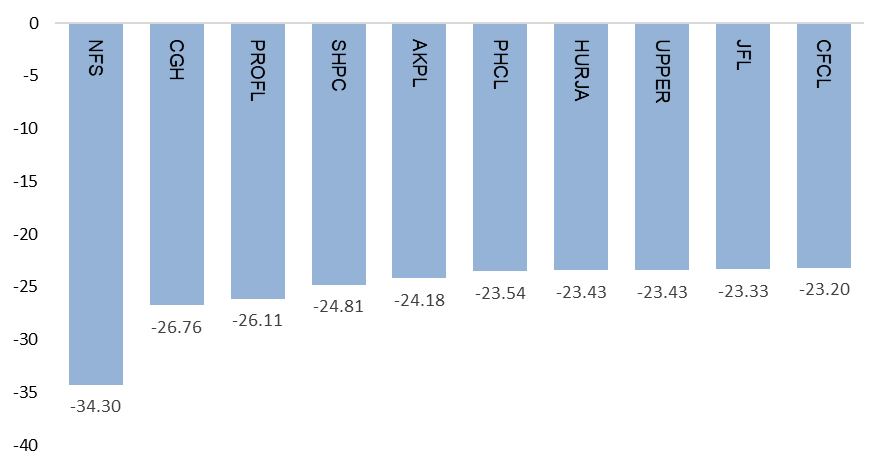

Losers – Bhadra (In %) |

|

|

|

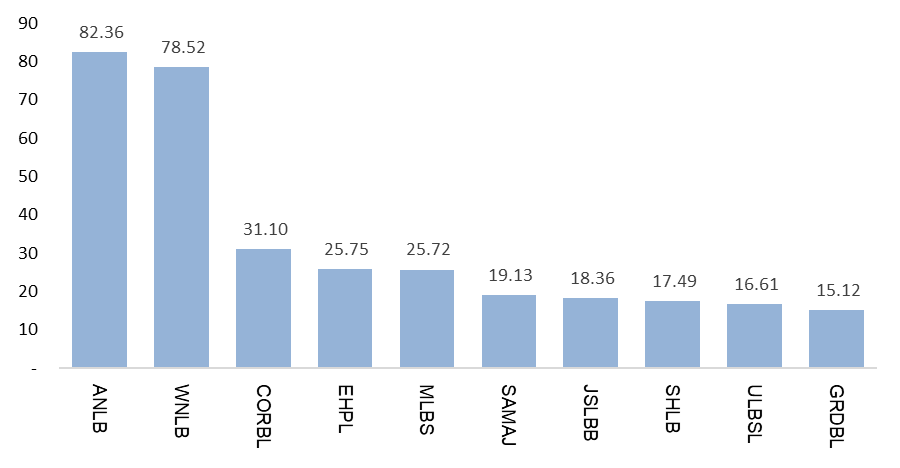

Top Buyer Brokers’ Top Buys (In Million) |

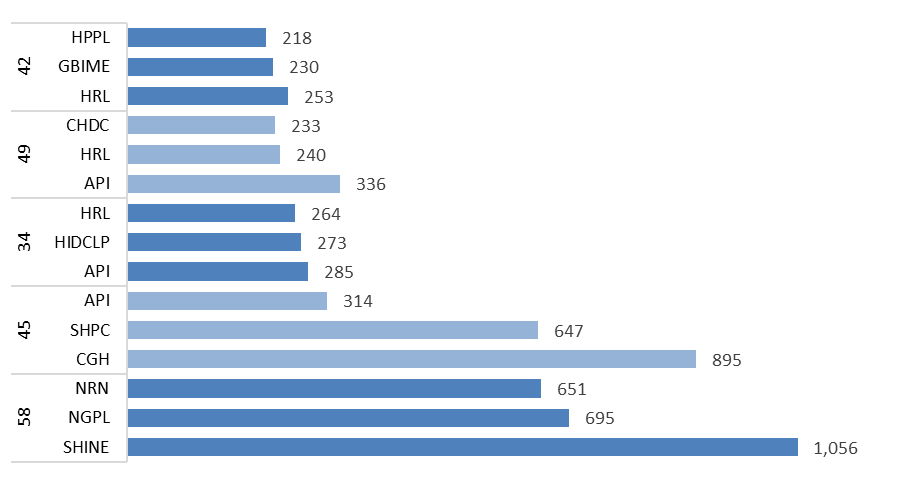

Top Seller Brokers’ Top Sells (In Million) |

|

|

|

Bank |

Call |

Saving |

FD Institution |

FD Individual |

Remittance |

Base Rate |

|||||||

|

Max |

Min |

Max |

6 mth |

9 mth |

1 Year |

3 mth |

6 mth |

9 mth |

1 Year |

>5 Years |

FD 1 Year |

||

|

ADBL |

1.50% |

3.00% |

5.76% |

3.75% |

3.75% |

3.75% |

4.00% |

4.32% |

5.07% |

5.07% |

0.00% |

7.07% |

7.63% |

|

CZBIL |

1.50% |

3.00% |

5.00% |

3.50% |

3.50% |

4.50% |

5.15% |

5.40% |

5.40% |

6.15% |

6.15% |

7.15% |

8.25% |

|

EBL |

1.50% |

3.00% |

4.05% |

3.15% |

3.15% |

3.15% |

4.15% |

4.15% |

4.15% |

4.15% |

6.00% |

5.15% |

7.00% |

|

GBIME |

1.50% |

3.00% |

4.50% |

4.00% |

4.00% |

4.50% |

4.00% |

5.00% |

5.00% |

5.50% |

6.25% |

6.50% |

7.37% |

|

HBL |

1.55% |

3.10% |

4.85% |

3.00% |

3.50% |

5.00% |

3.50% |

4.25% |

5.00% |

6.00% |

7.00% |

6.75% |

8.86% |

|

KBL |

1.51% |

3.01% |

6.01% |

3.03% |

3.03% |

3.25% |

4.31% |

4.81% |

4.81% |

5.31% |

5.81% |

6.31% |

8.52% |

|

LSL |

1.50% |

3.00% |

6.00% |

4.00% |

4.00% |

5.00% |

4.50% |

5.00% |

5.00% |

6.00% |

6.50% |

7.00% |

8.39% |

|

MBL |

1.50% |

3.00% |

6.00% |

4.25% |

4.25% |

4.75% |

5.50% |

6.00% |

6.00% |

6.50% |

7.00% |

6.00% |

7.63% |

|

NABIL |

1.50% |

3.00% |

6.00% |

4.00% |

4.00% |

4.00% |

5.00% |

5.00% |

5.00% |

5.00% |

6.75% |

6.00% |

7.42% |

|

NBL |

1.51% |

3.01% |

6.01% |

3.30% |

3.30% |

3.30% |

4.55% |

4.55% |

4.55% |

4.55% |

5.95% |

6.95% |

7.54% |

|

NIMB |

1.50% |

3.00% |

5.00% |

4.50% |

4.50% |

4.50% |

4.75% |

4.75% |

5.50% |

5.50% |

6.50% |

6.50% |

7.98% |

|

NMB |

1.51% |

3.02% |

5.52% |

3.50% |

3.50% |

4.50% |

0.00% |

4.50% |

4.50% |

5.50% |

6.50% |

6.50% |

7.62% |

|

NICA |

1.63% |

3.27% |

6.27% |

3.00% |

3.00% |

3.00% |

5.00% |

5.05% |

5.05% |

5.60% |

7.18% |

0.00% |

9.22% |

|

PRVU |

0.50% |

3.00% |

6.00% |

3.10% |

3.10% |

3.10% |

0.00% |

5.10% |

5.10% |

5.10% |

6.10% |

7.10% |

7.60% |

|

PCBL |

1.50% |

3.00% |

5.95% |

4.25% |

4.25% |

4.50% |

5.00% |

5.25% |

5.25% |

6.25% |

6.25% |

7.25% |

8.34% |

|

SCB |

1.50% |

3.00% |

5.05% |

3.75% |

3.75% |

4.00% |

4.50% |

4.50% |

4.50% |

4.75% |

7.00% |

5.75% |

5.93% |

|

SBI |

1.51% |

3.02% |

3.22% |

3.35% |

3.35% |

4.35% |

4.00% |

4.35% |

4.35% |

5.35% |

6.00% |

6.35% |

7.92% |

|

SBL |

1.00% |

3.00% |

5.50% |

3.50% |

3.50% |

4.25% |

5.00% |

5.00% |

5.00% |

5.75% |

6.50% |

6.75% |

7.54% |

|

SANIMA |

1.52% |

3.04% |

5.04% |

3.50% |

3.50% |

4.30% |

4.50% |

4.50% |

5.40% |

5.40% |

5.95% |

6.95% |

7.58% |

|

KSBBL |

1.50% |

3.00% |

6.00% |

4.00% |

4.00% |

5.25% |

4.25% |

5.25% |

5.25% |

6.25% |

7.00% |

7.25% |

8.88% |

|

MLBL |

1.53% |

3.05% |

5.05% |

4.15% |

4.15% |

4.25% |

0.00% |

5.15% |

5.15% |

5.25% |

6.50% |

6.25% |

8.96% |

|

SADBL |

1.50% |

3.00% |

4.50% |

4.00% |

4.00% |

5.00% |

4.50% |

5.50% |

5.50% |

6.50% |

6.50% |

7.50% |

8.82% |

|

MNBBL |

1.52% |

3.05% |

6.05% |

4.10% |

4.25% |

5.50% |

0.00% |

5.10% |

5.20% |

6.05% |

6.50% |

7.05% |

8.81% |

|

JBBL |

1.50% |

3.00% |

5.00% |

3.00% |

3.00% |

3.25% |

3.00% |

4.00% |

4.00% |

5.00% |

6.50% |

6.00% |

9.17% |

|

GBBL |

1.50% |

3.00% |

6.00% |

4.00% |

4.00% |

5.00% |

4.50% |

5.00% |

5.00% |

6.00% |

6.50% |

7.00% |

8.49% |

|

LBBL |

1.53% |

3.05% |

6.05% |

0.00% |

0.00% |

5.00% |

0.00% |

5.25% |

5.25% |

5.75% |

7.50% |

7.50% |

9.46% |

|

SHINE |

1.50% |

3.00% |

6.00% |

4.25% |

4.25% |

5.25% |

0.00% |

5.25% |

5.25% |

6.25% |

6.75% |

7.25% |

8.73% |

|

BFC |

2.50% |

5.00% |

7.00% |

6.00% |

6.25% |

6.55% |

6.75% |

7.00% |

7.25% |

7.55% |

7.95% |

8.55% |

12.22% |

|

CFCL |

n/a |

5.00% |

6.00% |

5.75% |

6.00% |

6.25% |

6.50% |

6.75% |

7.00% |

7.25% |

0.00% |

8.25% |

10.38% |

|

GFCL |

2.00% |

4.00% |

5.00% |

0.00% |

0.00% |

5.25% |

6.00% |

6.25% |

6.45% |

6.75% |

7.25% |

7.75% |

10.28% |

|

GUFL |

2.25% |

4.50% |

6.50% |

5.00% |

5.25% |

5.45% |

6.75% |

7.00% |

7.25% |

7.35% |

7.45% |

8.35% |

9.90% |

|

ICFC |

n/a |

4.00% |

5.00% |

0.00% |

0.00% |

5.00% |

4.75% |

5.00% |

5.00% |

6.75% |

7.05% |

7.75% |

9.39% |

|

MFIL |

2.00% |

4.20% |

6.20% |

0.00% |

0.00% |

5.50% |

5.75% |

6.00% |

6.00% |

6.50% |

7.25% |

7.50% |

10.98% |

|

PFL |

1.85% |

4.00% |

5.75% |

3.75% |

4.00% |

4.50% |

0.00% |

4.75% |

5.00% |

5.50% |

7.50% |

6.50% |

9.69% |

|

PROFL |

2.00% |

4.75% |

6.60% |

5.75% |

6.00% |

6.25% |

6.60% |

6.75% |

7.00% |

7.25% |

0.00% |

8.25% |

10.61% |

|

RLFL |

2.25% |

4.75% |

6.00% |

5.50% |

5.75% |

6.00% |

6.00% |

6.50% |

6.75% |

7.00% |

8.25% |

8.00% |

10.96% |

|

SFCL |

2.25% |

5.10% |

7.10% |

5.75% |

6.10% |

6.90% |

6.50% |

6.75% |

7.10% |

7.90% |

8.15% |

8.90% |

15.00% |

|

SIFC |

2.50% |

5.00% |

6.00% |

5.25% |

0.00% |

5.80% |

6.25% |

6.25% |

0.00% |

6.80% |

7.10% |

7.80% |

10.93% |

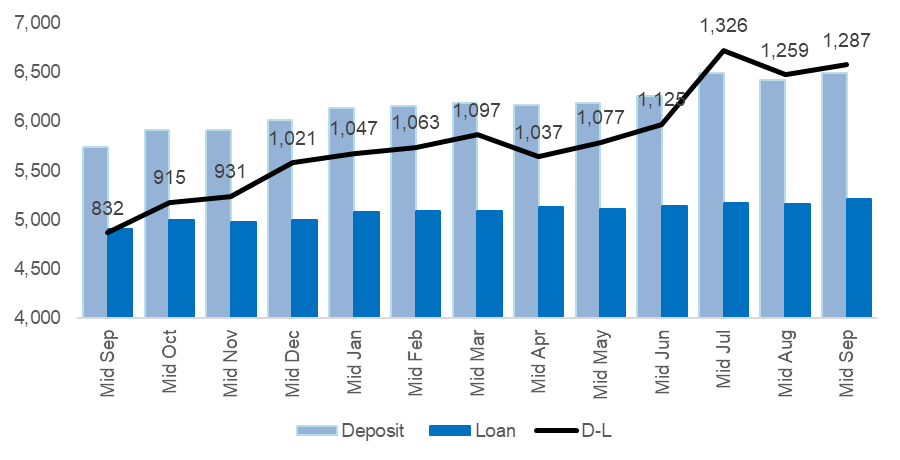

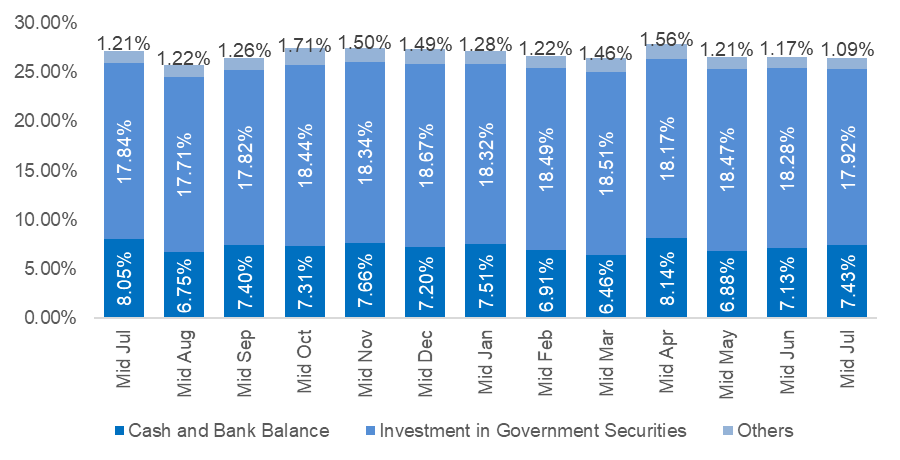

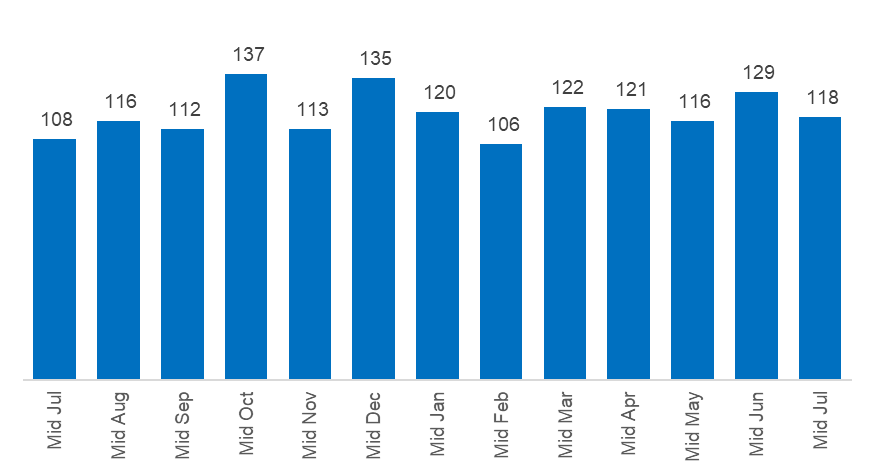

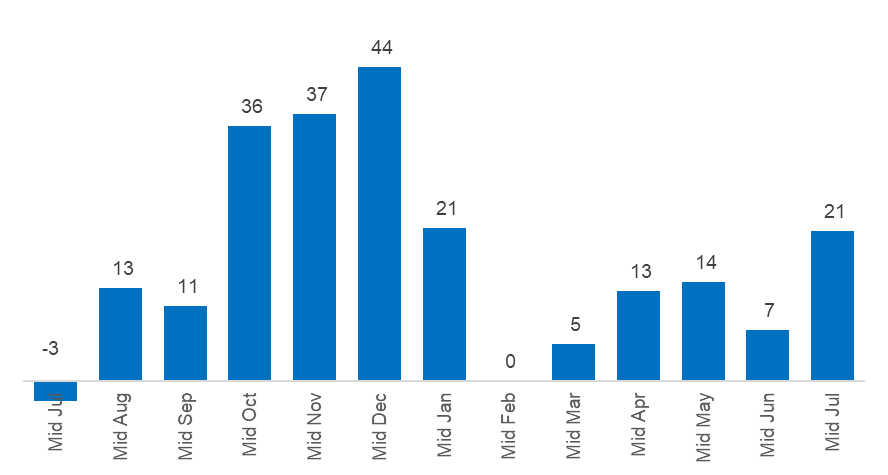

Rising liquidity as indicated by deposit growth driven by external and fiscal inflows, while loan demand declines

|

Deposit Vs Loan (In Billions) |

Liquidity Ratios |

|

|

|

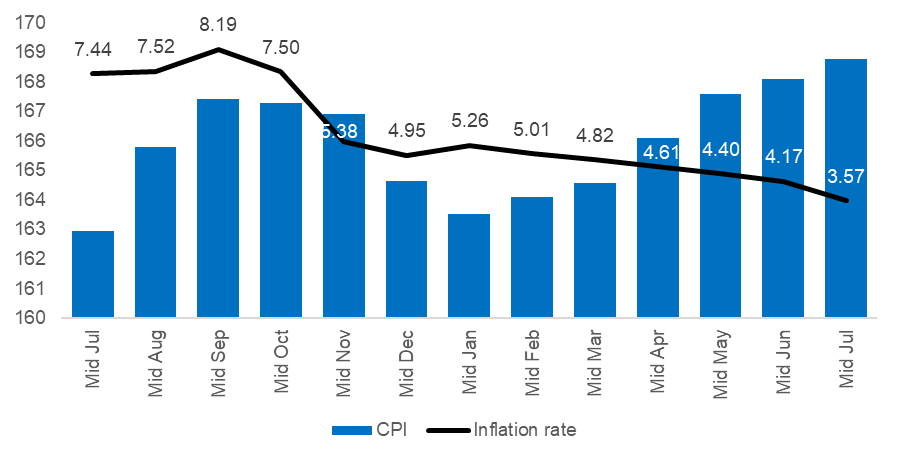

Inflation Rate and CPI |

Inflation Rate and WPI |

|

|

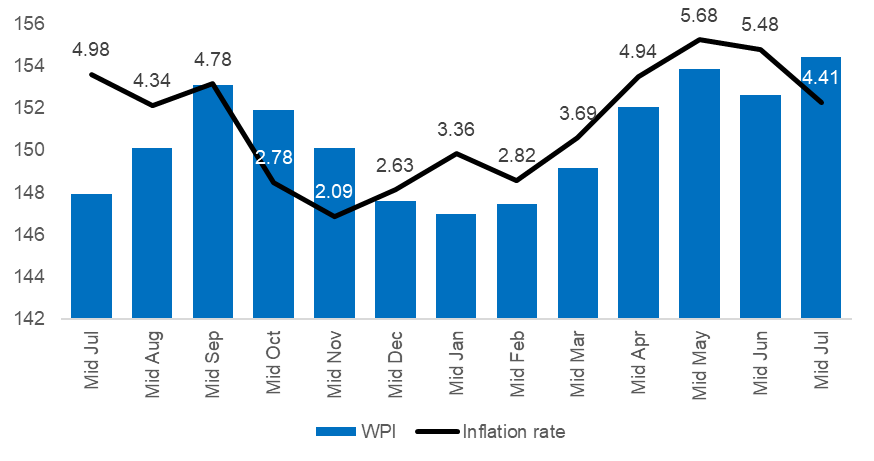

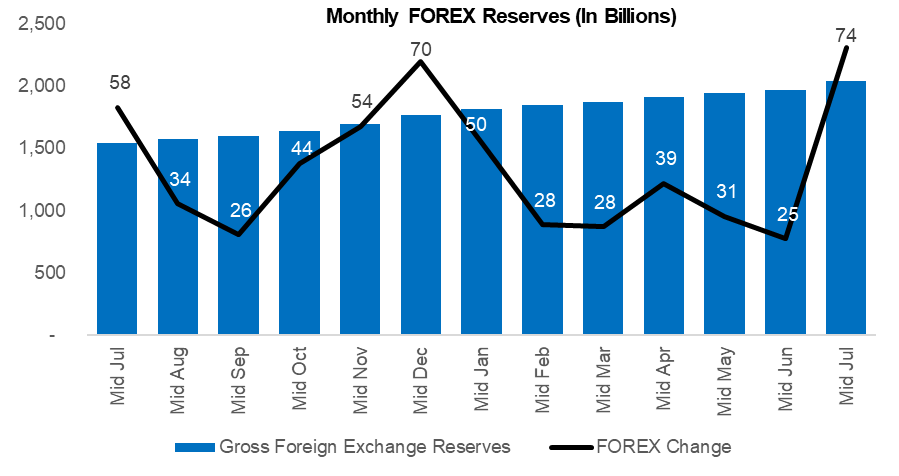

Steady remittance growth along with slowdown in consumption has driven a current account surplus and strengthened the external sector

|

Monthly Trade Balance (in Billions) |

Monthly Remittance Flows (In Billions) |

|

|

|

Monthly Current Account Balance (In Billions) |

Monthly FOREX Reserves (In Billions) |

|

|

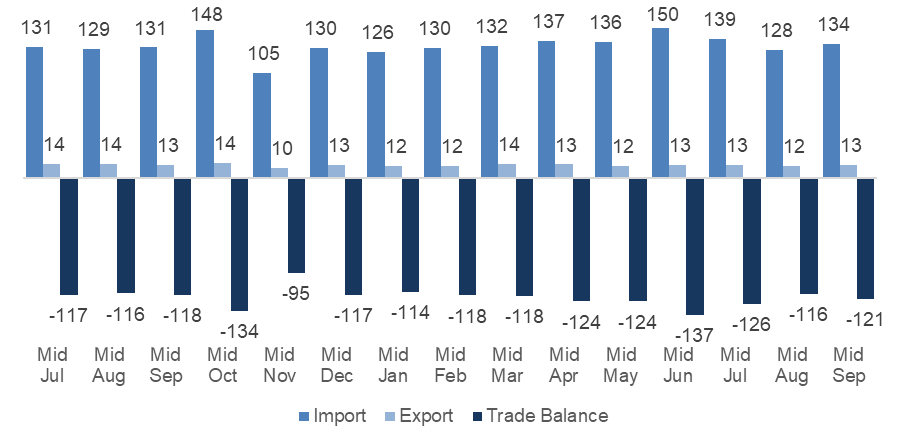

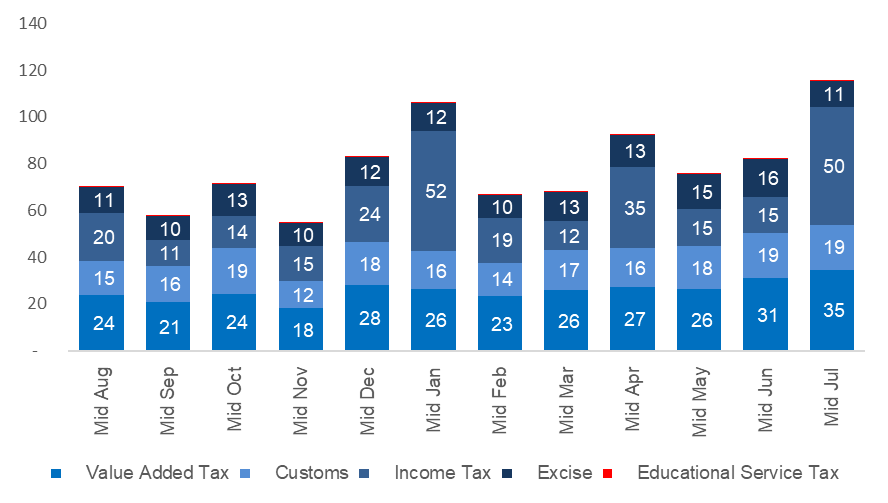

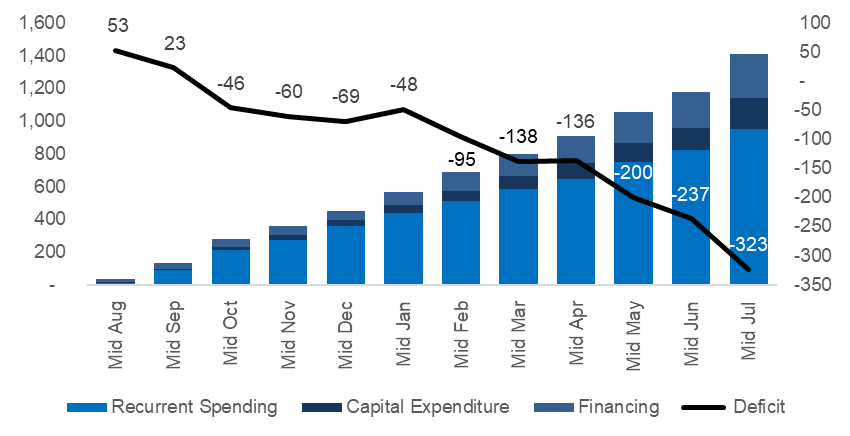

Continuous government deficits have injected liquidity into the economy but have also elevated public debt.

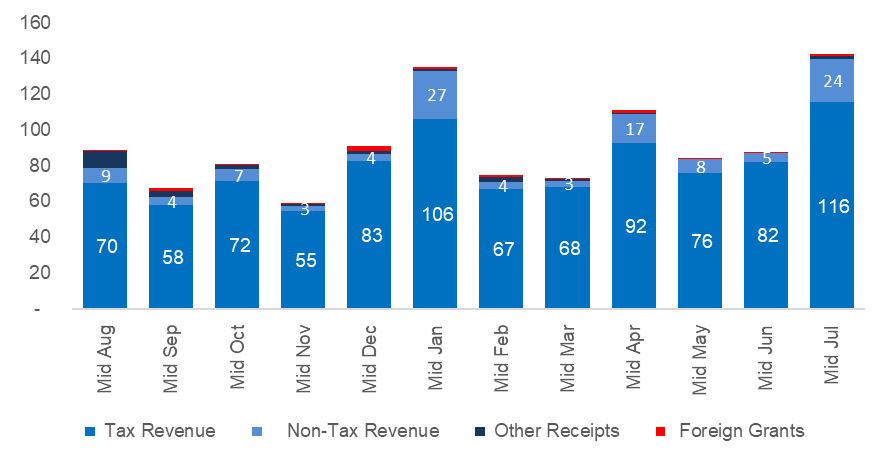

| Monthly Tax revenue (In Billions) | Monthly Government revenue (In Billions) |

|

|

|

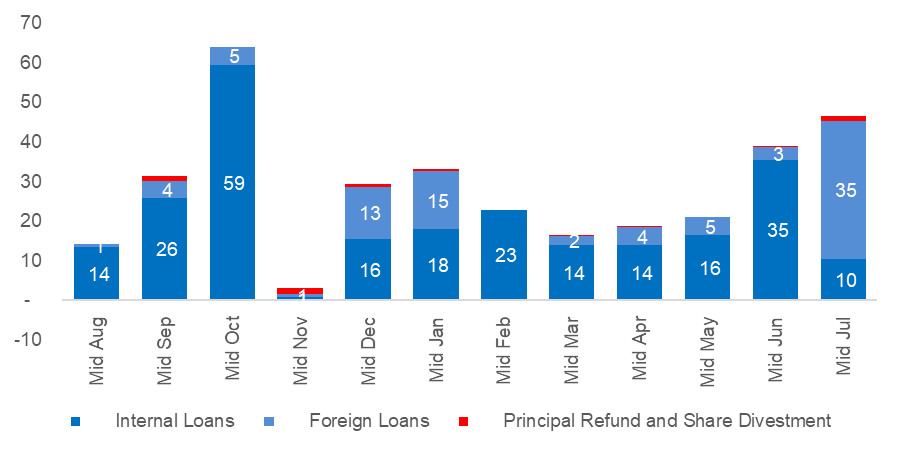

Monthly source financing (In Billions) |

Government Spending and Deficit over the period (In Billions) |

|

|

The market is expected to stay flat during the festive season but may rise once it ends.

|

The market surged toward an all-time high but failed to hold above 3,000, subsequently trending downward with declining turnover. The festive season has also played a role, as the market typically dips with low turnover during this period.

On the positive side, liquidity has surged, as indicated by rising deposits driven by substantial government deficit spending and a stable external sector, bolstered by record-high remittances. The widening government deficit has further injected capital into the private sector, exerting downward pressure on interest rates and prompting banks to steadily lower deposit rates each month.

Looking ahead, we anticipate that liquidity levels will remain stable, with the current influx of liquidity expected to persist in the near term. Key factors supporting this surge—high government deficit spending, sustained remittance inflows, and stable low interest rates—are likely to continue, fostering a vibrant market environment and sustaining market vitality.

However, while liquidity is expected to remain stable, it is not the sole driver of the market’s current strength. The primary catalyst has been positive political developments. Yet, Nepal’s political landscape has historically been volatile, and any shifts in the political climate could adversely affect market performance. Furthermore, long-term returns are ultimately dependent on the future earnings of the companies in which we invest. However, many of the listed companies are currently facing financial distress, which could present additional risks.

|

Lenders with low base rates are likely to outperform in the current environment, as borrowers will seek lower-cost loans. Additionally, quality clients from high base rate lenders may shift to those with lower rates to reduce their borrowing costs.

Falling interest rates will not affect all sectors equally. Insurance companies that depend on investment income, particularly those with a significant portion of their investments in fixed deposits of banks and financial institutions, are likely to underperform. Among insurers, life insurers are expected to be the most severely impacted by the current situation.

The biggest beneficiaries of falling interest rates are likely to be hydropower companies and microfinance institutions, as their high leverage means the current sharp decline in rates will significantly reduce their interest costs, boosting profitability.

However, despite the falling rates, loan demand remains sluggish and is unlikely to rebound quickly. The private sector, particularly institutions, is burdened with heavy debt, as indicated by the Private Debt-to-GDP ratio, which has surged to 100% following the COVID boom. Corporates are currently focused on deleveraging and reducing their debt levels, which may dampen loan demand further. Without a credit boom, the economic recovery could be prolonged.

Overall, we recommend investors exercise caution when entering the equity market at this point, as prices remain elevated with no clear signs of an economic recovery to sustain current levels. Be particularly wary of pump-and- dump schemes frequently targeting low-float stocks. |

|

Increase allocations in sector and companies that benefits from the falling interest rates. Eg: Microfinances and Hydropower. |

|

Exercise caution with manipulated low-float stocks prone to pump-and-dump schemes. Eg: Low-float finance, microfinance and Hydropower companies. |

|

Increase allocation to low base rate banks, as loan clients may shift from banking institutions with a higher base rate, but prioritize prudent lenders. |

|

The sharp decline in interest rates is expected to affect the earnings of insurance companies, particularly impacting life insurers more significantly than non-life insurers. |

|

Liquidity is expected to remain ample, with interest rates continuing to decline in the current economic climate. Gradually, fixed deposits may be redirected into the stock market for better yields. However, the weak loan demand highlights challenges in the private sector, burdened by high debt levels as reflected in the elevated private debt-to-GDP ratio. |

|

Disclaimer : Tathyanka’s Monthly Market Brief is for informational purposes only and is not financial advice. While efforts are made to ensure accuracy, Tathyanka is not liable for errors or omissions. Investors should do their own research or consult a financial advisor. Past performance does not guarantee future results. |

SHARE

View all

Market Brief For Ashoj 2081

Tathyanka’s Monthly Market Brief offers a succinct yet comprehensive overview of market trends, equity performance, and economic conditions, presented with in-depth charts and tables. This timely report spans a wide range of markets and investment themes, making it an essential tool for understanding how evolving market dynamics impact investor portfolios. Use the Monthly Market Brief as a go-to resource to enhance discussions and deepen your insights into the financial landscape.

Tathyanka’s Monthly Market Brief offers a succinct yet comprehensive overview of market trends, equity performance, and economic conditions, presented with in-depth charts and tables. This timely report spans a wide range of markets and investment themes, making it an essential tool for understanding how evolving market dynamics impact investor portfolios. Use the Monthly Market Brief as a go-to resource to enhance discussions and deepen your insights into the financial landscape.