Insurance analytics platform

Smarter Risk, Claims, and Market Insights for Modern Insurers

Our Insurance Analytics Platform enables insurers and financial institutions to analyze risk exposure, claims performance, underwriting efficiency, and market trends with precision. Access actionable insights through comprehensive dashboards and structured reports designed to support data-driven decision-making.

total Life Investment

7.89 Kh

total Non Life Investment

64.87 Ar

life Policies

58.97 L

non Life Policies

13.41 L

Quarterly Investment Details

Monthly KPI Dashboard

Insurance Market Analytics and Report Overview

Navigate the complexities of the insurance sector with Tathyanka's Insurance Analytics and Report Overview. Our platform delivers detailed evaluations of sector-wide trends and solvency benchmarks, providing the essential insights needed to optimize risk management and drive profitability in an evolving market.

With our detailed reports, you gain access to:

- Premium Trends: Monitor fluctuations in Gross Written Premiums across life and non-life sectors.

- Loss Ratio Benchmarks: Evaluate your claims performance against regional and industry-wide loss ratios.

- Actuarial Insights: Identify emerging risk patterns to refine pricing strategies and reserve allocations.

- Product Penetration: Discover underserved market segments and high-growth insurance product categories.

Our tools transform actuarial data and market statistics into actionable intelligence through intuitive visualizations. Whether you are an underwriter, claims manager, or insurance executive, Tathyanka equips you with the precision data required to manage liabilities and capitalize on new opportunities.

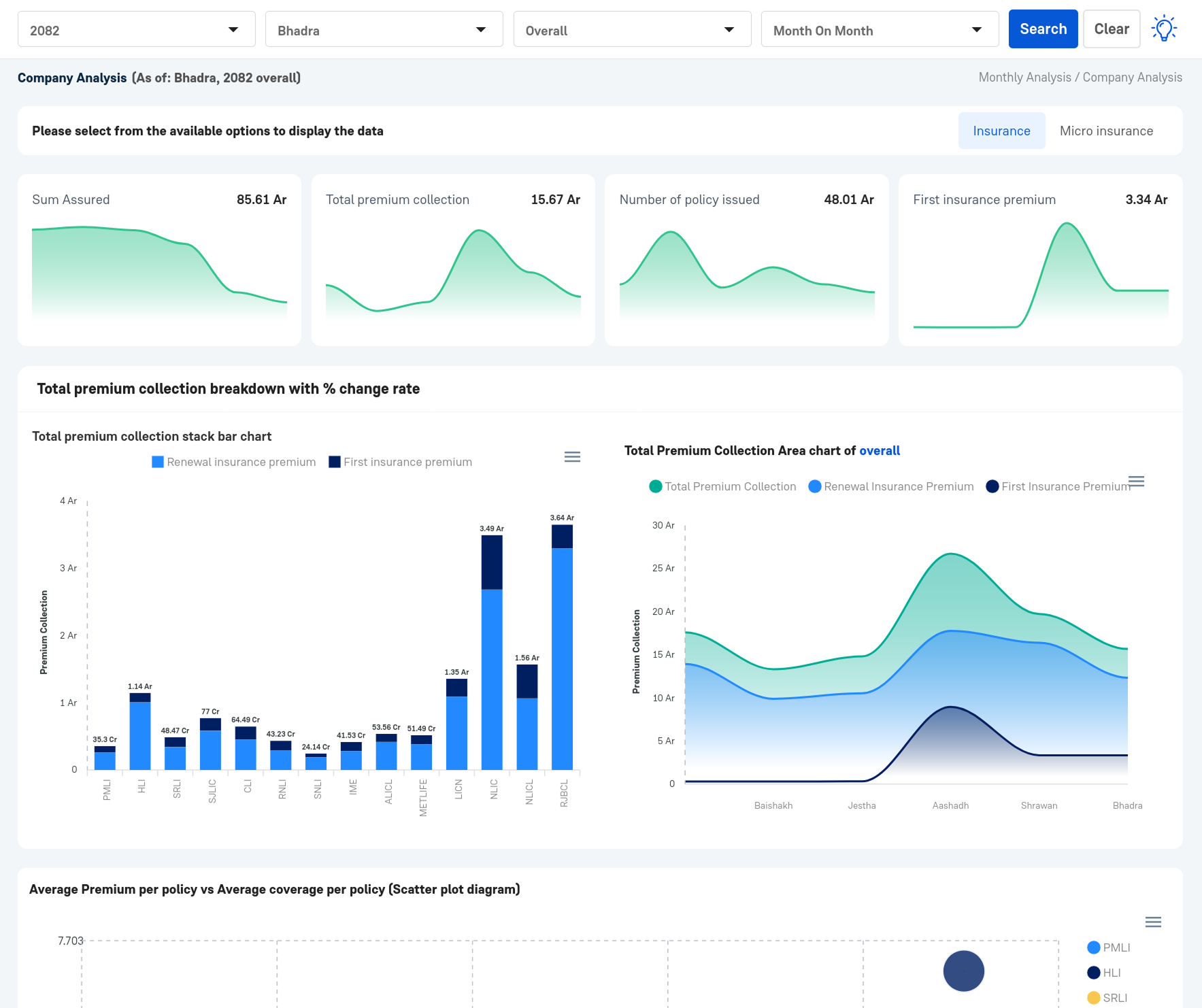

Monthly Underwriting and Claims Analytics

Optimize your operational efficiency with Tathyanka's monthly insurance insights. Our service tracks and visualizes your monthly premium collections, claim settlements, and renewal rates. By converting raw operational data into clear visual formats, we help you monitor key performance indicators such as expense ratios and combined ratios. Stay responsive to market shifts with accurate, real-time data analysis that highlights your policyholder behavior and financial trajectory.

Key Elements of Monthly Insurance Reports

Underwriting Dashboards

Track policy issuance, premium growth, and rejection rates in real-time. These dashboards visualize your underwriting throughput, helping you identify bottlenecks and maintain high-quality risk selection.

Technical Account Analysis

Deep dive into your technical results. Our reports analyze earned premiums against incurred claims and commissions, providing a clear picture of your core insurance profitability.

Reserves and Liabilities

Monitor the adequacy of your technical reserves. Our reports offer an overview of IBNR (Incurred But Not Reported) and outstanding claim reserves to ensure long-term solvency and regulatory compliance.

Claims and Renewals

Analyze monthly claim frequencies and severities alongside policy renewal rates. Understand customer retention patterns and the impact of large losses on your monthly performance.

Geospatial Risk Map

Visualize risk concentration and premium distribution across different geographic regions. Identify high-risk zones and optimize your agency network distribution and disaster management planning.

Market Share Comparison

Benchmarking your company's performance against the broader insurance market. Compare your growth rates and loss ratios to industry averages to refine your competitive market positioning.

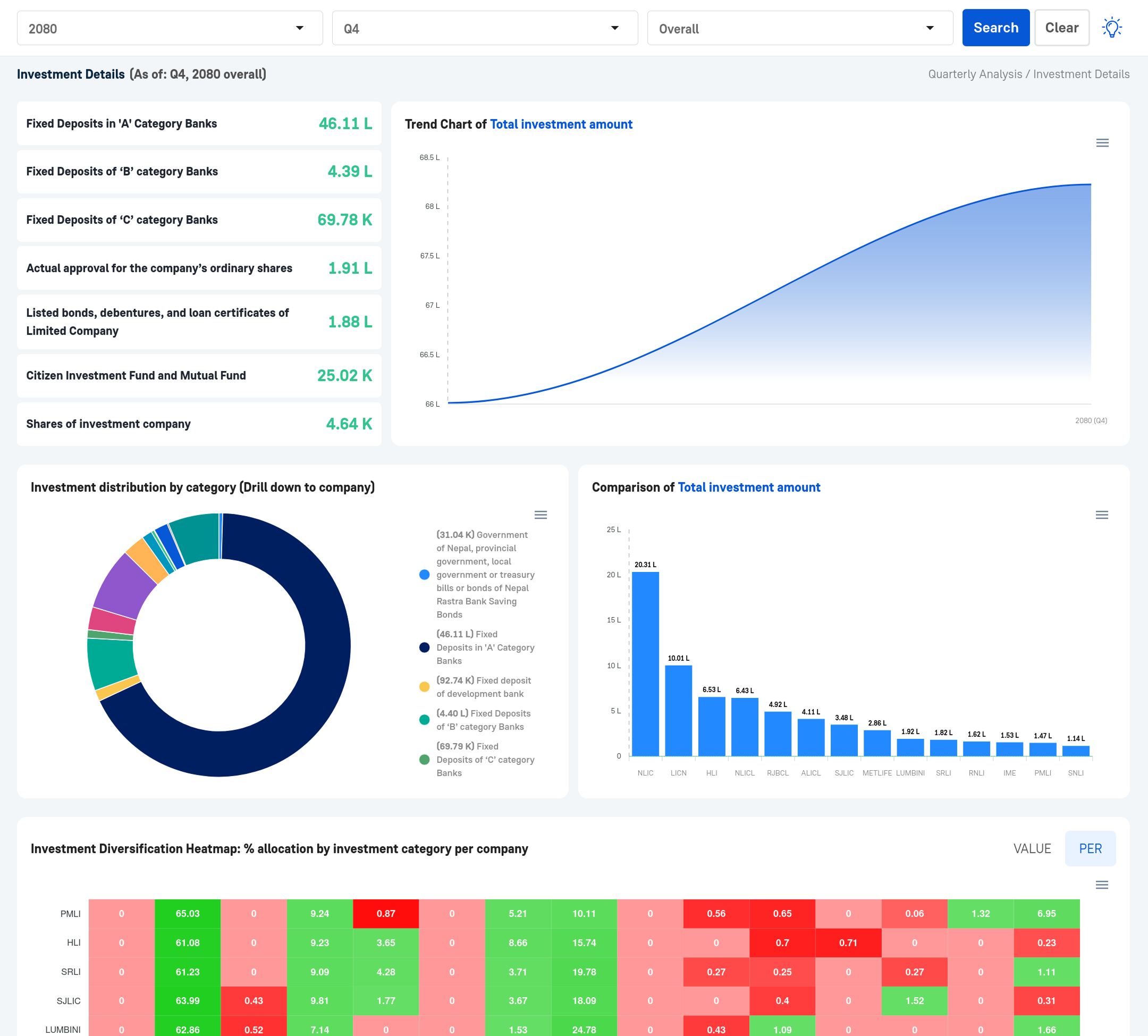

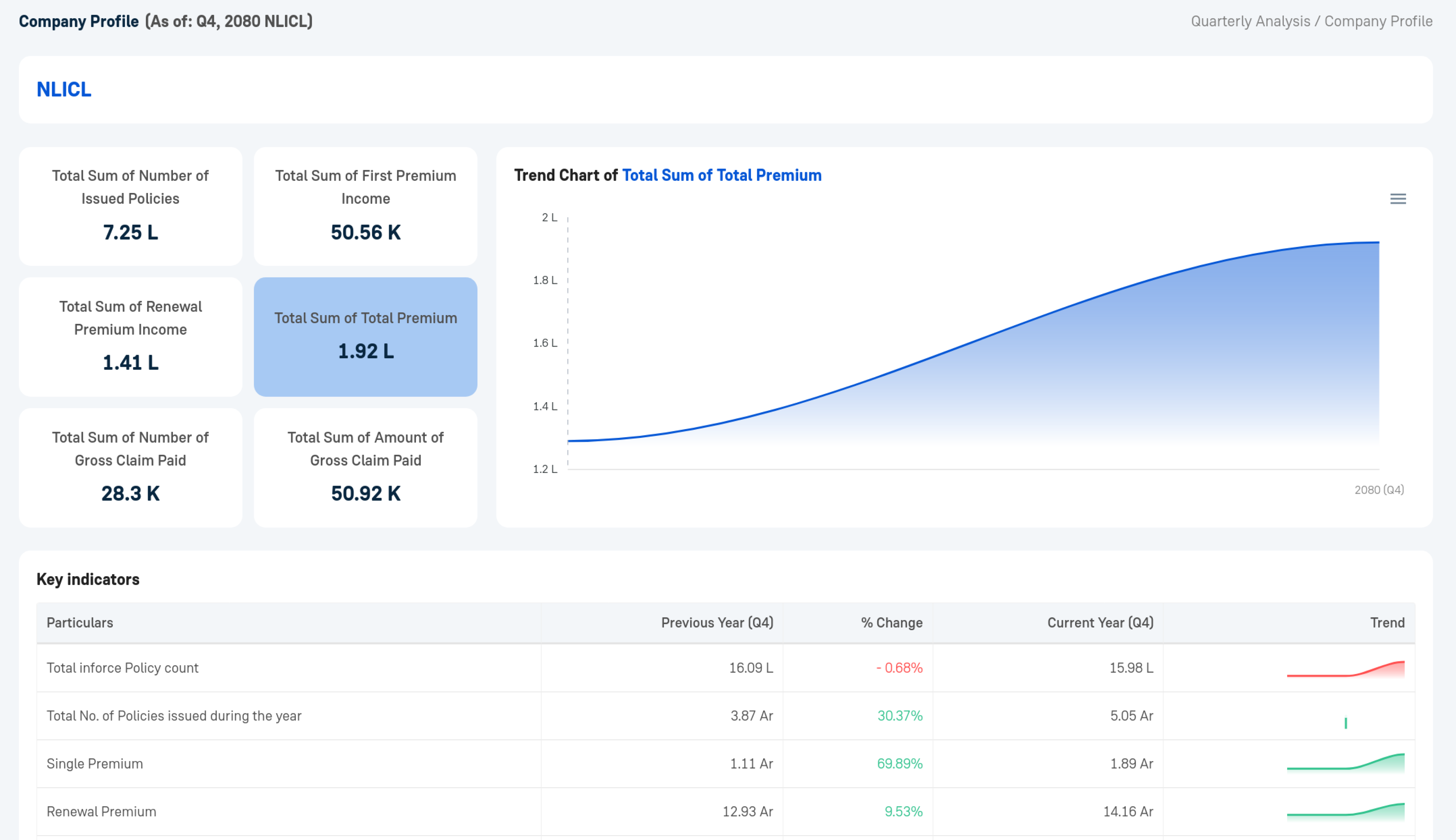

Strategic Quarterly and Annual Reviews

Drive long-term strategy with Tathyanka's comprehensive Quarterly and Annual Insurance Reports. These high-level summaries provide a detailed post-mortem of your financial and underwriting performance over extended periods.

Our reports synthesize investment income, underwriting profit, and operational expenses to provide a holistic view of your company’s health. With our actionable data, you can effectively plan reinsurance treaties, capital allocation, and future product launches to stay ahead in a competitive landscape.

Key Elements of Quarterly and Annual Reports

Solvency Margin Summary

A concise overview of your capital adequacy and solvency margins. This summary highlights your ability to meet long-term obligations, ensuring regulatory compliance and policyholder security at a glance.

Executive Portfolio Dashboard

An interactive tool visualizing long-term trends in investment yields, underwriting results, and expense management. It allows executives to drill down into product-line performance and regional profitability in real-time.

Peer Benchmarking Sheet

Compare your annual metrics—such as retention ratios and return on equity—against top industry performers. This tool identifies your competitive advantages and flags areas for strategic operational improvement.

Insurance Analytics Key Benefits

Holistic Risk Assessment

Our platform provides an end-to-end analysis of underwriting, claims, and investment risks, utilizing advanced modeling to ensure you have a complete view of your liabilities and assets.

Dynamic Data Visualization

With interactive charts and maps, insurers can explore complex actuarial datasets with ease, identifying potential loss trends and adjusting pricing parameters to simulate various market scenarios.

Actionable Sector Insights

Our platform delivers valuable insights into the economic factors impacting the insurance market, from regulatory changes to shifts in consumer demand, helping you make data-driven decisions based on real-time market statistics.