Quarterly results published by commercial banks as on Kartik 2081 shows convincing and adequate growth in major performance indicators . In this article we have tried to highlight the major performance indicators of commercial banks as on Kartik 2081.

Performance Analysis of Commercial Banks- Kartik 2081

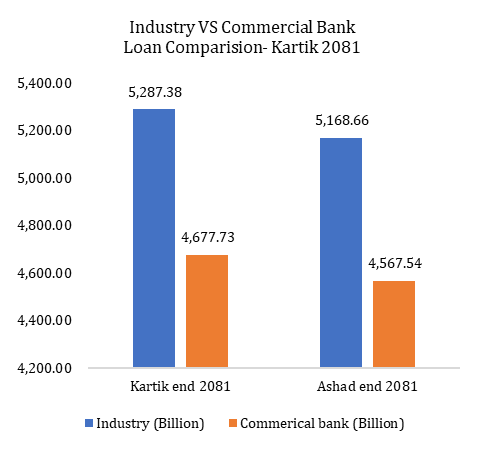

Loans and Advances:

Global IME Bank has the highest portfolio of loans and advance as on Kartik 2081 of Rs.420.75 Billion followed by NABIL Bank with loan portfolio of Rs.395.25 Billion amongst all commercial banks. Loans to Customers stood at Rs.402.28 Billion for Global IME Bank while loans to BFIs remained at Rs. 17.19 Billion. Lowest Loan portfolio is of Standard Chartered Bank Limited with Loan amount of Rs. 86.02 Billion.

In terms of Year-to-Date growth, Global IME Bank managed to increase its total loan by nearly Rs.30 Billion followed by increment of Rs.18.53 Billion by NIMB Bank. In terms of negative growth NIC ASIA Bank suffered significant decrement in its loan portfolio by Rs.23.74 Billion as compared to Ashadh 2081. Overall Industry loans including bills purchased grew by 2.30% till Kartik 2081 while commercial bank’s loans grew above industry average i.e. by 2.41% till Kartik 2081 as compared to Ashadh 2081.

(Rs. in Bn)

|

Bank Name

|

Rank

|

Kartik 2081

|

Ashadh 2081

|

Variance Amount

|

Variance %

|

|

Total loan

|

Loan to customers

|

Loan to BFIs

|

Loan to Gov Org

|

Total loan

|

Loan to customers

|

Loan to BFIs

|

Loan to Gov Org

|

Total loan

|

Loan to customers

|

Loan to BFIs

|

Loan to Gov Org

|

Total loan

|

Loan to customers

|

Loan to BFIs

|

Loan to Gov Org

|

|

|

Global

|

1

|

420.75

|

402.28

|

17.19

|

1.28

|

390.77

|

372.83

|

16.63

|

1.30

|

29.99

|

29.45

|

0.56

|

(0.02)

|

7.67%

|

7.90%

|

3.37%

|

-1.50%

|

|

NABIL

|

2

|

395.24

|

381.01

|

14.23

|

-

|

386.82

|

374.02

|

12.8

|

-

|

8.42

|

6.99

|

1.43

|

-

|

2.18%

|

1.87%

|

11.17%

|

0.00%

|

|

NIMB

|

3

|

347.39

|

332.39

|

12.79

|

2.21

|

328.85

|

314.99

|

12.19

|

1.67

|

18.53

|

17.4

|

0.6

|

0.54

|

5.64%

|

5.52%

|

4.92%

|

32.21%

|

|

Kumari

|

4

|

305.66

|

293.01

|

12.65

|

-

|

293.41

|

281.25

|

12.16

|

-

|

12.24

|

11.76

|

0.49

|

-

|

4.17%

|

4.18%

|

4.03%

|

0.00%

|

|

RBB

|

5

|

267.14

|

256.28

|

9.42

|

1.45

|

261.78

|

248.41

|

12.32

|

1.05

|

5.36

|

7.87

|

-2.9

|

0.39

|

2.05%

|

3.17%

|

-23.54%

|

37.25%

|

|

Laxmi

|

6

|

266.75

|

257.76

|

8.99

|

-

|

257.57

|

249.15

|

8.42

|

-

|

9.18

|

8.61

|

0.57

|

-

|

3.56%

|

3.46%

|

6.77%

|

0.00%

|

|

NIC

|

7

|

261.59

|

256.96

|

4.63

|

-

|

285.33

|

273.98

|

11.35

|

-

|

(23.74)

|

-17.02

|

-6.72

|

-

|

-8.32%

|

-6.21%

|

-59.21%

|

0.00%

|

|

HBL

|

8

|

242.67

|

233.4

|

9.12

|

0.16

|

247.10

|

236.22

|

10.6

|

0.27

|

(4.42)

|

-2.82

|

-1.48

|

(0.11)

|

-1.79%

|

-1.19%

|

-13.96%

|

-40.81%

|

|

Prabhu

|

9

|

228.76

|

217.25

|

11.03

|

0.48

|

234.38

|

223.18

|

11.19

|

-

|

(5.62)

|

-5.93

|

-0.16

|

0.48

|

-2.40%

|

-2.66%

|

-1.43%

|

0.00%

|

|

NMB

|

10

|

218.62

|

209.75

|

8.87

|

-

|

204.51

|

196.3

|

8.21

|

-

|

14.11

|

13.45

|

0.66

|

-

|

6.90%

|

6.85%

|

8.04%

|

0.00%

|

|

NBL

|

11

|

215.36

|

208.7

|

6.66

|

-

|

207.96

|

201.47

|

6.49

|

-

|

7.40

|

7.23

|

0.17

|

-

|

3.56%

|

3.59%

|

2.62%

|

0.00%

|

|

SBL

|

12

|

210.35

|

204.27

|

6.08

|

-

|

203.16

|

197.17

|

5.84

|

0.15

|

7.19

|

7.1

|

0.24

|

(0.15)

|

3.54%

|

3.60%

|

4.11%

|

-100.00%

|

|

ADBNL

|

13

|

205.56

|

202.4

|

3.16

|

-

|

206.68

|

203.44

|

3.24

|

-

|

(1.12)

|

-1.04

|

-0.08

|

-

|

-0.54%

|

-0.51%

|

-2.47%

|

0.00%

|

|

Prime

|

14

|

199.98

|

188.85

|

11.13

|

-

|

191.91

|

182.26

|

9.64

|

-

|

8.07

|

6.59

|

1.49

|

-

|

4.21%

|

3.62%

|

15.46%

|

0.00%

|

|

EBL

|

15

|

197.21

|

187.22

|

7.92

|

2.07

|

186.51

|

177.08

|

7.83

|

1.59

|

10.71

|

10.14

|

0.09

|

0.48

|

5.74%

|

5.73%

|

1.15%

|

30.43%

|

|

Sanima

|

16

|

169.79

|

163.42

|

6.37

|

-

|

165.78

|

160.23

|

5.55

|

-

|

4.01

|

3.19

|

0.82

|

-

|

2.42%

|

1.99%

|

14.77%

|

0.00%

|

|

Citizen

|

17

|

161.65

|

159.76

|

1.87

|

0.02

|

157.59

|

155.71

|

1.85

|

0.02

|

4.06

|

4.05

|

0.02

|

(0.00)

|

2.57%

|

2.60%

|

1.08%

|

-4.33%

|

|

MBL

|

18

|

137.83

|

132.06

|

5.64

|

0.13

|

130.69

|

125.36

|

5.19

|

0.13

|

7.14

|

6.7

|

0.45

|

-

|

5.47%

|

5.34%

|

8.67%

|

0.00%

|

|

NSBI

|

19

|

132.32

|

126.29

|

6.03

|

-

|

132.97

|

126.55

|

6.42

|

-

|

(0.65)

|

-0.26

|

-0.39

|

-

|

-0.49%

|

-0.21%

|

-6.07%

|

0.00%

|

|

SCBNL

|

20

|

86.02

|

80.6

|

5.42

|

-

|

86.82

|

82.27

|

4.56

|

-

|

(0.81)

|

-1.67

|

0.86

|

-

|

-0.93%

|

-2.03%

|

18.86%

|

0.00%

|

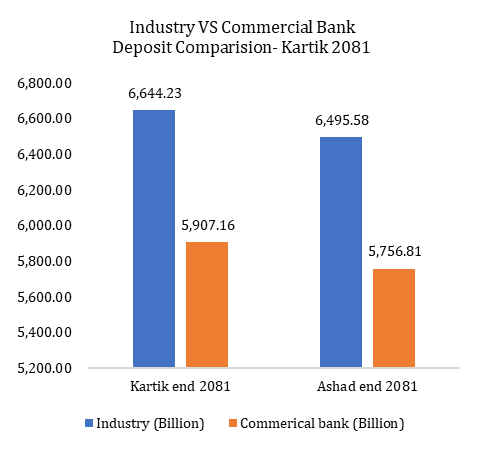

Deposits:

Overall Industry deposit grew by 2.29% till Kartik 2081 while commercial bank deposit increased by 2.61% till Kartik 2081. Global IME Bank has the highest deposit portfolio size of Rs.526.60 Billion as on Kartik 2081 followed by NABIL Bank with Rs.484.71 Billion and NIMB Bank with Rs.439.24 Billion. In terms of low-cost deposit, CASA of Standard Chartered Bank is the highest of 64.05% followed by Rastriye Banijye Bank with CASA of 53.40%. Prime Commercial Bank has the lowest CASA of 23.17% as on Kartik 2081. NIC ASIS Bank diluted its deposit portfolio by Rs.43.57 Billion whereas Prabhu Bank diluted by Rs.8.17 Billion. NIC let go fixed deposit worth Rs. 55.71 Billion till Kartik 2081 as compared to Ashadh 2081. In terms of deposit increment NIMB Bank managed to increase its total deposit by Rs.32.43 Billion followed by increment of Rs.20.12 Billion by Himalayan Bank Limited.

(Rs. in Bn)

|

Deposit

(Rs. in Bn)

|

Rank

|

Kartik 2081

|

Increment / (Decrement) From Ashadh 2081

|

|

Total

Deposit

|

Current

|

Savings

|

Fixed

|

Call Deposits

|

Others

|

CASA

|

Total

Deposit

|

Current

|

Savings

|

Fixed

|

Call Deposits

|

Others

|

|

Global

|

1

|

526.60

|

27.51

|

184.68

|

277.46

|

32.84

|

4.12

|

40.29%

|

21.71

|

(1.39)

|

17.28

|

2.70

|

2.45

|

0.67

|

|

NABIL

|

2

|

484.71

|

39.32

|

156.48

|

239.46

|

45.74

|

3.71

|

40.40%

|

15.95

|

(2.13)

|

21.41

|

(9.85)

|

6.47

|

0.05

|

|

NIMB

|

3

|

439.24

|

28.55

|

120.23

|

240.35

|

45.94

|

4.16

|

33.87%

|

32.43

|

1.62

|

7.41

|

13.84

|

9.68

|

(0.13)

|

|

RBB

|

4

|

428.81

|

32.80

|

196.19

|

173.27

|

25.09

|

1.45

|

53.40%

|

(1.90)

|

(7.09)

|

22.08

|

(3.91)

|

(12.97)

|

(0.02)

|

|

Kumari

|

5

|

362.60

|

15.44

|

97.32

|

211.80

|

36.00

|

2.04

|

31.10%

|

11.84

|

(0.02)

|

9.17

|

(2.88)

|

5.58

|

(0.01)

|

|

Laxmi

|

6

|

338.24

|

15.28

|

112.55

|

189.21

|

18.64

|

2.57

|

37.79%

|

4.84

|

(1.82)

|

13.64

|

(2.63)

|

(4.63)

|

0.29

|

|

HBL

|

7

|

317.85

|

16.59

|

84.85

|

189.98

|

21.97

|

4.46

|

31.92%

|

20.12

|

1.21

|

7.89

|

6.50

|

2.96

|

1.56

|

|

NIC

|

8

|

316.97

|

10.40

|

103.07

|

182.93

|

20.36

|

0.21

|

35.80%

|

(43.57)

|

(4.17)

|

13.69

|

(55.71)

|

2.68

|

(0.06)

|

|

Prabhu

|

9

|

304.06

|

12.92

|

106.87

|

163.44

|

18.47

|

2.36

|

39.40%

|

(8.17)

|

(4.96)

|

9.86

|

(7.76)

|

(5.22)

|

(0.08)

|

|

NBL

|

10

|

289.22

|

20.60

|

120.70

|

125.64

|

19.77

|

2.51

|

48.85%

|

5.65

|

(4.19)

|

13.38

|

(3.64)

|

0.14

|

(0.04)

|

|

ADBNL

|

11

|

261.52

|

14.04

|

74.80

|

162.02

|

9.96

|

0.69

|

33.97%

|

17.76

|

(6.32)

|

1.88

|

21.45

|

0.81

|

(0.06)

|

|

SBL

|

12

|

245.58

|

12.51

|

85.91

|

128.53

|

17.12

|

1.51

|

40.08%

|

0.67

|

(0.48)

|

8.57

|

(1.40)

|

(6.11)

|

0.09

|

|

EBL

|

13

|

244.42

|

14.66

|

72.56

|

139.29

|

15.56

|

2.35

|

35.68%

|

11.03

|

(1.41)

|

5.19

|

3.35

|

3.75

|

0.15

|

|

NMB

|

14

|

241.71

|

9.82

|

82.08

|

127.78

|

18.90

|

3.13

|

38.02%

|

14.60

|

(1.57)

|

5.93

|

7.70

|

2.65

|

(0.11)

|

|

Prime

|

15

|

224.06

|

5.50

|

46.42

|

154.53

|

15.15

|

2.47

|

23.17%

|

8.46

|

(2.64)

|

2.51

|

9.33

|

(0.98)

|

0.24

|

|

Sanima

|

16

|

203.26

|

9.85

|

65.67

|

111.48

|

15.01

|

1.26

|

37.15%

|

3.88

|

0.01

|

6.80

|

(5.12)

|

2.41

|

(0.22)

|

|

Citizen

|

17

|

194.43

|

7.23

|

61.29

|

111.57

|

13.33

|

1.01

|

35.24%

|

2.75

|

(0.87)

|

6.46

|

(2.88)

|

0.08

|

(0.04)

|

|

NSBI

|

18

|

186.15

|

8.87

|

55.23

|

106.29

|

13.73

|

2.02

|

34.44%

|

10.73

|

0.65

|

2.92

|

3.95

|

3.02

|

0.18

|

|

MBL

|

19

|

169.47

|

7.17

|

59.99

|

89.02

|

11.63

|

1.67

|

39.63%

|

8.10

|

(0.55)

|

3.75

|

4.86

|

(0.19)

|

0.23

|

|

SCBNL

|

20

|

128.28

|

34.93

|

47.24

|

34.74

|

9.99

|

1.39

|

64.05%

|

13.45

|

11.38

|

2.14

|

3.12

|

(2.98)

|

(0.21)

|

Non-Banking Assets (NBA):

In terms of NBA, Global IME Bank and NIC ASIA Bank hold the significant amount of investment property worth Rs.5131.33 Million and Rs.4226.09 Million respectively as on Kartik 2081. NIC ASIA however managed to get rid of NBA worth Rs.135.57 Million. Looking into increment from Ashadh 2081, Himalayan Bank’s non-banking assets grew by hefty 50.57% as compared to Ashadh 2081 followed by Kumari Bank with increment by 39.42%..

(Rs. in Mn)

|

Bank

|

Rank

|

Kartik 2081

|

Ashadh 2081

|

Variance Amount

|

Variance %

|

|

NBA

(Rs. in Mn)

|

NBA

(Rs. in Mn)

|

|

Global

|

1

|

5,131.33

|

5,040.34

|

90.99

|

1.81%

|

|

NIC

|

2

|

4,226.09

|

4,361.67

|

(135.57)

|

-3.11%

|

|

HBL

|

3

|

3,636.05

|

2,414.93

|

1,221.12

|

50.57%

|

|

NIMB

|

4

|

3,039.46

|

3,016.50

|

22.96

|

0.76%

|

|

Kumari

|

5

|

2,667.38

|

1,913.18

|

754.20

|

39.42%

|

|

NABIL

|

6

|

2,649.74

|

2,574.77

|

74.97

|

2.91%

|

|

Prime

|

7

|

1,697.10

|

1,911.87

|

(214.77)

|

-11.23%

|

|

Laxmi

|

8

|

1,598.81

|

1,563.13

|

35.68

|

2.28%

|

|

Prabhu

|

9

|

1,059.11

|

795.36

|

263.75

|

33.16%

|

|

MBL

|

10

|

1,033.20

|

1,201.90

|

(168.71)

|

-14.04%

|

|

NMB

|

11

|

1,026.47

|

851.44

|

175.04

|

20.56%

|

|

ADBNL

|

12

|

983.39

|

943.09

|

40.30

|

4.27%

|

|

Citizen

|

13

|

809.91

|

821.26

|

(11.35)

|

-1.38%

|

|

Sanima

|

14

|

708.58

|

674.00

|

34.58

|

5.13%

|

|

SBL

|

15

|

703.89

|

727.57

|

(23.68)

|

-3.25%

|

|

EBL

|

16

|

511.23

|

522.30

|

(11.07)

|

-2.12%

|

|

NSBI

|

17

|

353.91

|

331.12

|

22.79

|

6.88%

|

|

RBB

|

18

|

297.65

|

305.59

|

(7.94)

|

-2.60%

|

|

NBL

|

19

|

204.11

|

205.74

|

(1.63)

|

-0.79%

|

|

SCBNL

|

20

|

-

|

-

|

-

|

0.00%

|

Investment:

In terms of Investment, Rastriye Banijye Bank held government securities investment worth Rs.136.82 Billion followed by Global IME Bank with Rs.130.25 Billion as on Kartik 2081. As compared to Ashadh 2081, NIC ASIA Bank diluted its investment in Government Securities by Rs.14.06 Billion followed by dilution of Rs.8.9 bIllion of Everest Bank Limited. In the same review period, Himalayan Bank managed to increase its government securities investment by Rs. 28.60 Billion followed by increment of Rs.20.48 Billion by Standard Chartered Bank. Looking into investment in shares and other areas NIMB Bank holds investment portfolio of Rs.42.19 Billion being the highest amongst the peer. NIMB Bank increased its portfolio by Rs.16.29 Billion during review period. Himalayan Bank on the other side decreased its holding by Rs.5.07 Billion during this review period.

(Rs. in Mn)

|

Bank

|

Kartik 2081

|

Ashadh 2081

|

Variance

|

|

Govt. Sec

Investment

|

Shares and Other Investment

|

Govt. Sec

Investment

|

Shares and Other Investment

|

Govt. Sec

Investment

|

Shares and Other Investment

|

|

Global

|

130,251.13

|

27,015.49

|

132,725.30

|

26,367.76

|

(2,474.17)

|

647.72

|

|

NABIL

|

98,230.36

|

29,695.23

|

95,541.95

|

22,695.17

|

2,688.41

|

7,000.06

|

|

NIMB

|

95,686.21

|

42,198.29

|

95,327.57

|

25,901.90

|

358.64

|

16,296.39

|

|

Kumari

|

83,952.86

|

16,632.33

|

72,539.16

|

15,426.27

|

11,413.71

|

1,206.07

|

|

Laxmi

|

78,360.75

|

24,359.75

|

77,632.10

|

24,355.48

|

728.65

|

4.27

|

|

RBB

|

136,820.38

|

6,803.59

|

145,353.35

|

6,784.33

|

(8,532.97)

|

19.26

|

|

NIC

|

58,493.36

|

6,695.41

|

72,559.60

|

7,373.90

|

(14,066.25)

|

(678.50)

|

|

HBL

|

68,555.86

|

21,786.27

|

39,950.68

|

26,864.83

|

28,605.19

|

(5,078.55)

|

|

Prabhu

|

80,361.42

|

15,601.18

|

84,290.79

|

10,275.51

|

(3,929.37)

|

5,325.68

|

|

NMB

|

38,655.59

|

14,246.89

|

40,038.76

|

12,750.21

|

(1,383.17)

|

1,496.69

|

|

NBL

|

72,369.71

|

12,042.90

|

69,722.45

|

10,396.84

|

2,647.26

|

1,646.06

|

|

SBL

|

47,088.19

|

19,607.59

|

51,473.77

|

17,863.75

|

(4,385.59)

|

1,743.85

|

|

ADBNL

|

78,642.74

|

17,495.16

|

67,493.21

|

14,428.12

|

11,149.53

|

3,067.04

|

|

Prime

|

45,014.55

|

12,071.03

|

43,992.20

|

10,560.96

|

1,022.35

|

1,510.07

|

|

EBL

|

53,443.62

|

11,184.41

|

62,390.06

|

9,947.18

|

(8,946.44)

|

1,237.23

|

|

Sanima

|

38,645.00

|

4,527.56

|

39,554.23

|

4,363.92

|

(909.24)

|

163.64

|

|

Citizen

|

35,055.22

|

5,601.74

|

34,857.18

|

5,050.47

|

198.04

|

551.27

|

|

MBL

|

33,090.76

|

8,045.09

|

33,203.20

|

6,245.29

|

(112.45)

|

1,799.80

|

|

NSBI

|

54,963.07

|

7,874.93

|

51,888.24

|

3,186.78

|

3,074.82

|

4,688.16

|

|

SCBNL

|

40,609.63

|

2,080.85

|

20,122.78

|

1,790.29

|

20,486.86

|

290.56

|

Net Interest Income (NII):

Nabil Bank has highest Net Interest Income of Rs.5.49 Billion followed by Global IME Bank of Rs.5.434 Billion. Standard Chartered Bank has lowest NII of Rs.1.552 Billion till Kartik 2081. Prabhu Bank’s NII increased by 20.62% on Y-O-Y basis while Everest Bank’s NII increased by 15.83%.

|

Bank Name

|

Rank

|

Kartik

|

Kartik

|

Y-O-Y Change

|

Change %

|

|

(NII)

|

2081

|

2080

|

|

NABIL

|

1

|

5,493.69

|

5,480.92

|

12.78

|

0.23%

|

|

Global

|

1

|

5,434.78

|

6,213.09

|

(778.32)

|

-12.53%

|

|

NIMB

|

2

|

4,694.43

|

5,011.48

|

(317.05)

|

-6.33%

|

|

Kumari

|

3

|

3,985.33

|

4,591.55

|

(606.22)

|

-13.20%

|

|

Laxmi

|

4

|

3,522.84

|

3,817.85

|

(295.01)

|

-7.73%

|

|

Prabhu

|

5

|

3,382.83

|

2,804.55

|

578.28

|

20.62%

|

|

NIC

|

6

|

3,345.55

|

3,564.81

|

(219.26)

|

-6.15%

|

|

HBL

|

7

|

3,174.97

|

4,100.76

|

(925.79)

|

-22.58%

|

|

Prime

|

8

|

3,019.58

|

2,628.74

|

390.85

|

14.87%

|

|

NBL

|

9

|

3,011.37

|

3,068.20

|

(56.83)

|

-1.85%

|

|

RBB

|

10

|

2,938.43

|

3,287.69

|

(349.26)

|

-10.62%

|

|

EBL

|

11

|

2,869.09

|

2,476.88

|

392.21

|

15.83%

|

|

SBL

|

12

|

2,759.10

|

2,646.58

|

112.52

|

4.25%

|

|

NMB

|

13

|

2,656.71

|

2,838.33

|

(181.62)

|

-6.40%

|

|

Citizen

|

14

|

2,028.98

|

1,897.04

|

131.94

|

6.96%

|

|

MBL

|

15

|

1,935.89

|

1,719.54

|

216.35

|

12.58%

|

|

Sanima

|

16

|

1,804.94

|

2,011.93

|

(206.99)

|

-10.29%

|

|

NSBI

|

17

|

1,723.87

|

1,828.19

|

(104.32)

|

-5.71%

|

|

ADBNL

|

18

|

1,650.89

|

2,956.17

|

(1,305.28)

|

-44.15%

|

|

SCBNL

|

19

|

1,552.07

|

1,819.57

|

(267.50)

|

-14.70%

|

Fees, Discount and Commission income:

Global IME Bank managed to collect highest fees and commission income till Kartik 2081 of Rs.1.33 Billion followed by Nabil Bank of Rs.1.31 Billion. In terms of Y-O-Y increment Prabhu Bank increased its fees and commission income by 122.38% and Standard Chartered Bank increased by 100.31%. In terms of lowest fees and commission income, Rastriye Banijye Bank collected Rs.85.75 Million during the review period though it is a Y-O-Y increment by 33.60%. NIC ASIA Bank saw decrement by 40.93% on its fees and commission income, mostly due to slow credit flow and dilution of existing portfolio.

|

Bank Name

|

Rank

|

Kartik 2081

|

Kartik 2080

|

Variance

|

Variance%

|

|

Global

|

1

|

1,333.16

|

1,095.71

|

237.45

|

21.67%

|

|

NABIL

|

2

|

1,316.91

|

1,222.47

|

94.45

|

7.73%

|

|

NMB

|

3

|

807.79

|

660.09

|

147.71

|

22.38%

|

|

Kumari

|

4

|

760.32

|

752.25

|

8.08

|

1.07%

|

|

Prabhu

|

5

|

756.19

|

340.04

|

416.14

|

122.38%

|

|

SBL

|

6

|

645.59

|

552.43

|

93.15

|

16.86%

|

|

SCBNL

|

7

|

615.20

|

307.13

|

308.07

|

100.31%

|

|

Laxmi

|

8

|

607.30

|

538.66

|

68.64

|

12.74%

|

|

EBL

|

9

|

604.31

|

523.39

|

80.92

|

15.46%

|

|

NIMB

|

10

|

579.23

|

530.38

|

48.86

|

9.21%

|

|

Prime

|

11

|

551.69

|

522.79

|

28.90

|

5.53%

|

|

NIC

|

12

|

549.67

|

930.48

|

(380.80)

|

-40.93%

|

|

MBL

|

13

|

509.90

|

423.78

|

86.12

|

20.32%

|

|

Citizen

|

14

|

443.73

|

397.47

|

46.27

|

11.64%

|

|

NBL

|

15

|

442.21

|

396.38

|

45.84

|

11.56%

|

|

NSBI

|

16

|

401.02

|

388.25

|

12.77

|

3.29%

|

|

HBL

|

17

|

326.68

|

362.05

|

(35.36)

|

-9.77%

|

|

ADBNL

|

18

|

223.72

|

214.81

|

8.92

|

4.15%

|

|

Sanima

|

19

|

107.68

|

86.05

|

21.63

|

25.14%

|

|

RBB

|

20

|

85.75

|

64.19

|

21.56

|

33.60%

|

LLP Expenses:

Highest LLP expenses was booked by Laxmi Bank of Rs.1.16 Billion followed by NIC ASIA Bank of Rs.1.16 Billion and Global IME bank with Rs.1.06 Billion. Prabhu Bank saw the increment of 383.73% on its LLP followed by Rastriye Banijye Bank with increment in its LLP by 366.66% in Kartik 2081 as compared to Kartik 2080.

|

PL Items

(Rs. in Mn)

|

Rank

|

Kartik 2081

|

Kartik 2080

|

Variance

Amount

|

Variance

%

|

|

Laxmi

|

1

|

1,167.99

|

2,146.52

|

(978.53)

|

-45.59%

|

|

NIC

|

2

|

1,164.34

|

644.31

|

520.03

|

80.71%

|

|

Global

|

3

|

1,069.23

|

1,770.05

|

(700.83)

|

-39.59%

|

|

SBL

|

4

|

1,022.42

|

1,434.81

|

(412.39)

|

-28.74%

|

|

NIMB

|

5

|

975.21

|

658.89

|

316.32

|

48.01%

|

|

Citizen

|

6

|

909.13

|

426.47

|

482.66

|

113.17%

|

|

ADBNL

|

7

|

902.53

|

2,130.99

|

(1,228.46)

|

-57.65%

|

|

NBL

|

8

|

711.25

|

1,187.14

|

(475.89)

|

-40.09%

|

|

RBB

|

9

|

643.21

|

137.83

|

505.37

|

366.66%

|

|

Kumari

|

10

|

630.69

|

2,183.14

|

(1,552.45)

|

-71.11%

|

|

Sanima

|

11

|

584.27

|

531.36

|

52.91

|

9.96%

|

|

Prime

|

12

|

490.65

|

201.05

|

289.59

|

144.04%

|

|

NABIL

|

13

|

457.73

|

1,111.67

|

(653.94)

|

-58.83%

|

|

Prabhu

|

14

|

384.17

|

79.42

|

304.75

|

383.73%

|

|

EBL

|

15

|

106.70

|

429.50

|

(322.80)

|

-75.16%

|

|

NMB

|

16

|

(37.04)

|

480.17

|

(517.21)

|

-107.71%

|

|

MBL

|

17

|

(43.42)

|

12.29

|

(55.71)

|

-453.27%

|

|

SCBNL

|

18

|

(100.39)

|

188.06

|

(288.45)

|

-153.38%

|

|

HBL

|

19

|

(270.81)

|

687.26

|

(958.07)

|

-139.40%

|

|

NSBI

|

20

|

(335.52)

|

415.00

|

(750.53)

|

-180.85%

|

HR Expenses Excluding Bonus:

Lowest HR cost excluding bonus was reported by Standard Chartered Bank followed by Nepal SBI Bank with Rs.482.93 Million. Major increment in HR costs is seen in NIC ASIA Bank with increment in Y-O-Y HR Costs by 31.52% followed by Laxmi Bank with increment by 24.30%. In case of HR costs downsize, Global IME Bank decreased its HR costs by 16.80% on year on year basis. Highest HR costs was reported by Rastriye Banijye Bank with HR costs of Rs.1.44 Billion followed by Nabil Bank of Rs.1.35 Billion.

|

Bank Name

|

Rank

|

Kartik 2081

|

Kartik 2080

|

Variance Amount

|

Variance %

|

|

RBB

|

1

|

1,441.96

|

1,266.25

|

175.72

|

13.88%

|

|

NABIL

|

2

|

1,355.12

|

1,437.32

|

(82.20)

|

-5.72%

|

|

Kumari

|

3

|

1,287.23

|

1,341.62

|

(54.39)

|

-4.05%

|

|

Laxmi

|

4

|

1,261.79

|

1,015.09

|

246.70

|

24.30%

|

|

Global

|

5

|

1,241.07

|

1,491.74

|

(250.67)

|

-16.80%

|

|

NBL

|

6

|

1,214.22

|

1,198.19

|

16.02

|

1.34%

|

|

Prabhu

|

7

|

1,213.97

|

1,092.92

|

121.05

|

11.08%

|

|

ADBNL

|

8

|

1,192.07

|

1,142.31

|

49.77

|

4.36%

|

|

NIC

|

9

|

1,163.44

|

884.61

|

278.82

|

31.52%

|

|

NIMB

|

10

|

1,015.34

|

964.17

|

51.17

|

5.31%

|

|

HBL

|

11

|

958.99

|

826.29

|

132.70

|

16.06%

|

|

SBL

|

12

|

903.95

|

787.00

|

116.96

|

14.86%

|

|

MBL

|

13

|

761.94

|

682.54

|

79.40

|

11.63%

|

|

NMB

|

14

|

747.59

|

697.37

|

50.22

|

7.20%

|

|

EBL

|

15

|

633.00

|

555.88

|

77.11

|

13.87%

|

|

Prime

|

16

|

584.58

|

478.44

|

106.14

|

22.18%

|

|

Citizen

|

17

|

549.63

|

525.04

|

24.59

|

4.68%

|

|

Sanima

|

18

|

538.45

|

473.31

|

65.15

|

13.76%

|

|

NSBI

|

19

|

482.93

|

517.58

|

(34.65)

|

-6.69%

|

|

SCBNL

|

20

|

371.20

|

351.07

|

20.13

|

5.73%

|

Operating Expenses:

Highest Operating expenses was reported by Global IME Bank of Rs.1.109 Billion followed by NIC ASIA Bank of Rs.1 Billion till Kartik 2081. This is because these banks have large number of branches triggering higher operating costs. Global IME saw the increment of 15.83% while NIC ASIA saw increment of 21.61%. On year-to-year basis NABIL Bank saw the highest increment by 21.26% on its operating expenses. Standard Chartered Bank maintained its lowest operating costs with Rs.198.15 Million down by 9.91% compared to Kartik 2080.

|

Bank

|

Rank

|

Kartik 2081

|

Kartik 2080

|

Variance Amount

|

Variance %

|

|

Global

|

1

|

1,109.13

|

957.54

|

151.59

|

15.83%

|

|

NIC

|

2

|

1,007.14

|

828.20

|

178.94

|

21.61%

|

|

NIMB

|

3

|

835.86

|

793.94

|

41.92

|

5.28%

|

|

Prabhu

|

4

|

816.45

|

773.27

|

43.18

|

5.58%

|

|

NABIL

|

5

|

775.29

|

639.34

|

135.94

|

21.26%

|

|

Laxmi

|

6

|

754.00

|

776.28

|

(22.28)

|

-2.87%

|

|

HBL

|

7

|

699.54

|

699.96

|

(0.42)

|

-0.06%

|

|

SBL

|

8

|

693.26

|

639.88

|

53.38

|

8.34%

|

|

Kumari

|

9

|

626.11

|

628.34

|

(2.23)

|

-0.36%

|

|

RBB

|

10

|

612.37

|

541.86

|

70.51

|

13.01%

|

|

ADBNL

|

11

|

531.36

|

479.86

|

51.50

|

10.73%

|

|

Citizen

|

12

|

455.32

|

399.79

|

55.53

|

13.89%

|

|

Sanima

|

13

|

453.55

|

444.76

|

8.79

|

1.98%

|

|

EBL

|

14

|

443.60

|

404.76

|

38.85

|

9.60%

|

|

NBL

|

15

|

408.87

|

424.75

|

(15.88)

|

-3.74%

|

|

MBL

|

16

|

400.34

|

391.26

|

9.08

|

2.32%

|

|

NMB

|

17

|

397.93

|

428.98

|

(31.05)

|

-7.24%

|

|

NSBI

|

18

|

347.19

|

359.26

|

(12.07)

|

-3.36%

|

|

Prime

|

19

|

341.56

|

302.10

|

39.46

|

13.06%

|

|

SCBNL

|

20

|

198.15

|

219.94

|

(21.79)

|

-9.91%

|

Loan Write Off:

Himalayan Bank has written off loans and advances worth Rs.903.65 Million followed by Machhapuchhere Bank with loan write off of Rs.270.55 Million. Amongst 20 commercial banks only 9 banks have written off their loans whereas remaining 11 banks have not written off their loans.

|

Bank

|

Rank

|

Kartik 2081

|

Kartik 2080

|

Variance

|

|

HBL

|

1

|

903.65

|

46.57

|

857.09

|

|

MBL

|

2

|

270.55

|

9.05

|

261.50

|

|

NABIL

|

3

|

114.30

|

-

|

114.30

|

|

NMB

|

4

|

36.41

|

-

|

36.41

|

|

NIC

|

5

|

12.37

|

129.28

|

(116.91)

|

|

SCBNL

|

6

|

3.49

|

9.03

|

(5.54)

|

|

Sanima

|

7

|

1.33

|

47.82

|

(46.49)

|

|

NIMB

|

8

|

0.95

|

423.82

|

(422.88)

|

|

Prabhu

|

9

|

0.06

|

165.00

|

(164.94)

|

|

Global

|

10

|

-

|

-

|

-

|

|

Kumari

|

10

|

-

|

-

|

-

|

|

Laxmi

|

10

|

-

|

-

|

-

|

|

Prime

|

10

|

-

|

-

|

-

|

|

NBL

|

10

|

-

|

-

|

-

|

|

RBB

|

10

|

-

|

-

|

-

|

|

EBL

|

10

|

-

|

-

|

-

|

|

SBL

|

10

|

-

|

7.57

|

(7.57)

|

|

Citizen

|

10

|

-

|

-

|

-

|

|

NSBI

|

10

|

-

|

-

|

-

|

|

ADBNL

|

10

|

-

|

-

|

-

|